AIM TO GIVE THE EDGE OF DERIVATIVES TOYOUR PORTFOLIO

An SIF framework under SEBI regulations, curated for strategy-led investing—designed to adapt, allocate and respond to markets, not merely follow them.

What is Titanium SIF?

Crafted for discerning investors, Titanium SIF combines resilience, strength and precision to navigate changing markets with discipline and agility. Designed for those who think beyond conventional equity, Titanium SIF aims to deliver an intelligent, multi-dimensional approach to wealth creation.

Create Wealth with Differentiated Strategies

Long-short strategies, multi-asset exposure and sector intelligence.

Curated for Discerning Investors

Exclusively designed for ₹10 lakh+ portfolio value.

Tax-Efficient, Regulated Structure

MF-like taxation with the comfort of a defined regulatory framework.

.svg)

Minimum Investment: ₹10,00,000

.svg)

Minimum Investment: ₹10,00,000

Aims to Deliver Risk-Adjusted Returns

Aims to participate in uptrends, manage downside in corrections, and stay tactical in range-bound markets.

Positioned to Capture Potential Opportunities Across Market Cycles

Seeks to participate in varied market phases—not only upward trends.

Multi-Asset Diversification

Allocate investments across multiple asset classes and instruments to broaden return sources.

Inception Date

24 November 2025

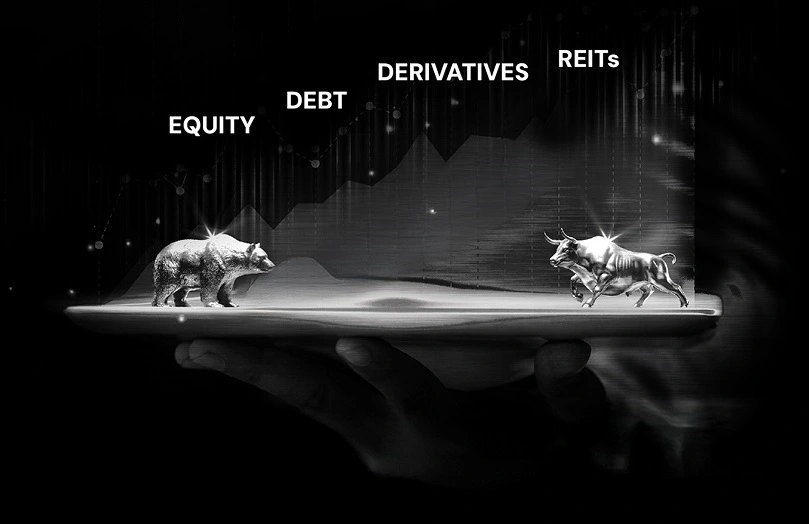

Benchmark

CRISIL Hybrid 50+50 - Moderate Index (TRI)

Exit Load

- On or before 1 Month from the date of allotment: 1.00%

- After 1 Month from the date of allotment: NIL

Explore Diverse Categories of SIF

Expand your investment toolkit with the diverse categories of Specialized Investment Funds (SIFs).

Equity Long–Short

Combines long and short equity positions so you can tactically participate and aim to protect the portfolio.

Ex-Top 100 Long–Short

Broadens potential opportunity beyond the top 100 companies by market-cap.

Sector Rotation Long–Short

Dynamically shifts among select sectors based on evolving trends.

Hybrid Long–Short

Blends equities, debt and short exposure through unhedged derivative positions in equity and debt instruments — helping you balance potential growth and risk in one strategy.

Debt Long–Short

Uses duration and derivative tools in debt markets to manage interest-rate and credit risk.

Sectoral Debt Long-Short Fund

Balances debt across sectors to seek opportunities with disciplined risk management.

Active Asset Allocator Long–Short

A multi-asset long–short allocation approach with tactical flexibility.

Connect with Our Team

Share your details and we’ll get in touch with you.

Frequently Asked Questions (FAQs)

Loading FAQs...