GIFT – Made in India,

for the World.

GIFT City is an emerging global financial services hub and a first of its kind in India. Be a part of India's growth story and aim to grow your investment portfolio. At Tata Asset Management, we are dedicated to helping you invest in opportunities that bring you closer to your financial aspirations.

To know more,

request a call back

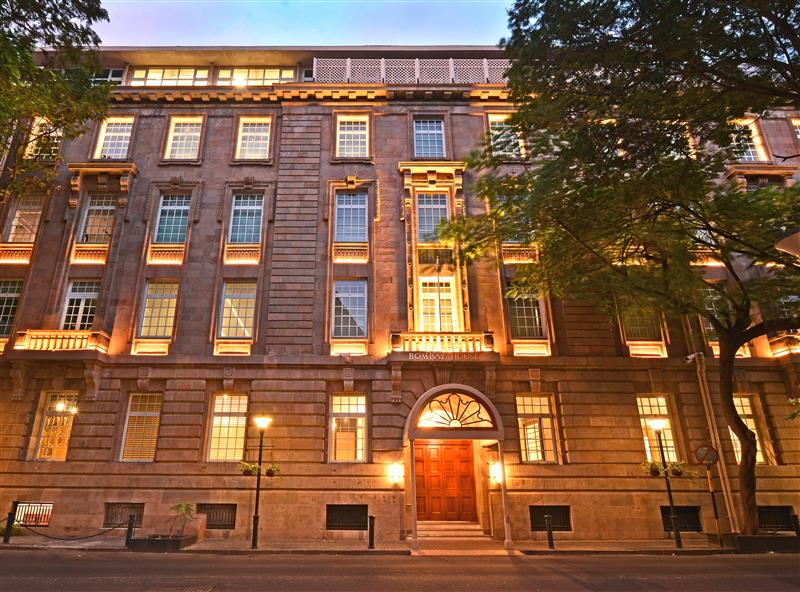

About Tata Asset Management

Tata Asset Management is one of the leading investment managers of India with 30+ years of expertise. We offer a range of investment solutions for financial planning for wealth creation, and manage funds across the entire risk-return spectrum. The diversity of our fund offerings enables investors to invest as per their life stage, financial goals and risk profiles. We also offer portfolio management services to high-net-worth individuals, and advisory services to offshore investors investing in India. With a focus on intellectual capital and strong risk management, we uphold transparency, excellence, and aim for long-term results.

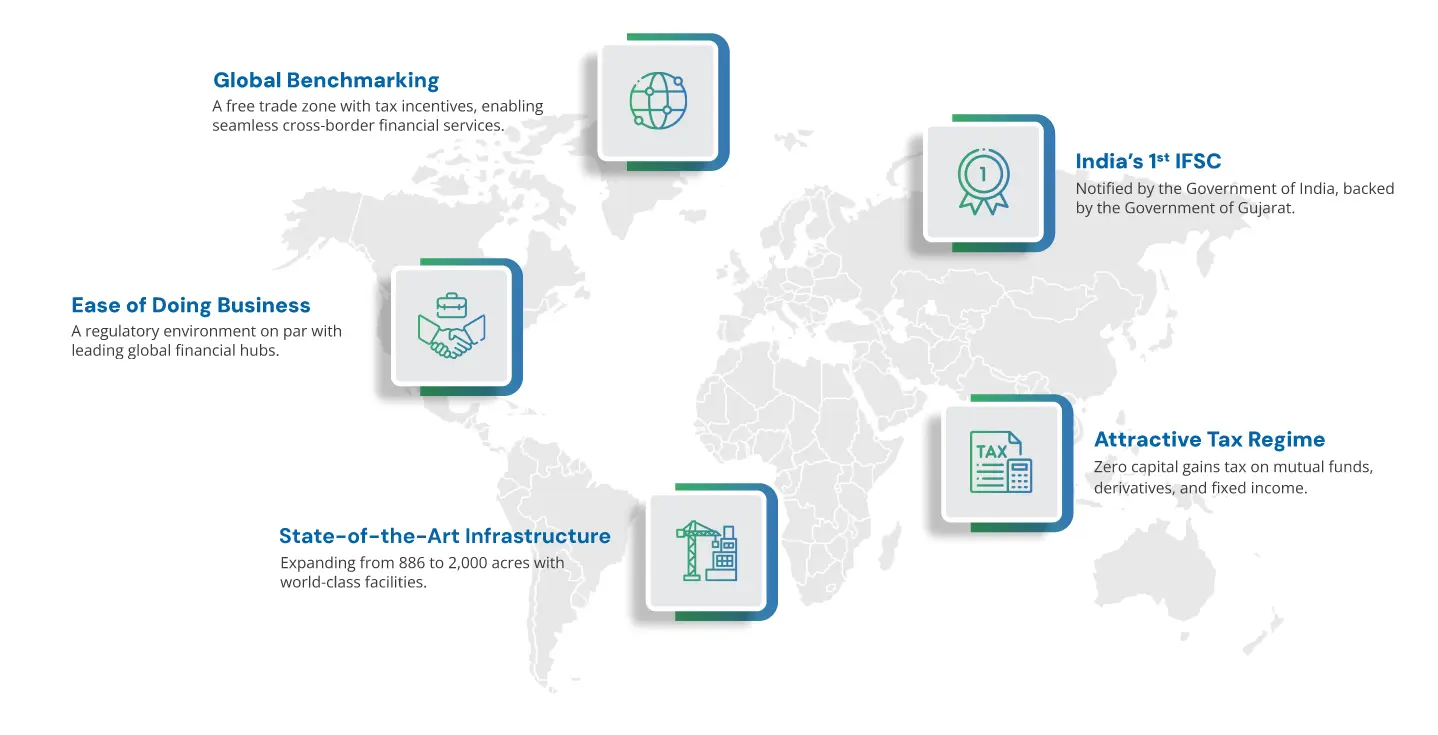

What is GIFT City

GIFT City, or Gujarat International Finance Tec-City, is India's first International Financial Services Centre (IFSC). It serves as a strategic gateway for global investments, offering top-tier infrastructure, a unified regulatory environment, and business-friendly operations. IFSC units function as non-residents under Forex regulations, facilitating effortless global transactions. Regulated by the International Financial Services Centres Authority (IFSCA), GIFT City offers streamlined services across securities, banking, insurance, and pensions.

What is GIFT City

GIFT City, or Gujarat International Finance Tec-City, is India's first International Financial Services Centre (IFSC). It serves as a strategic gateway for global investments, offering top-tier infrastructure, a unified regulatory environment, and business-friendly operations. IFSC units function as non-residents under Forex regulations, facilitating effortless global transactions. Regulated by the International Financial Services Centres Authority (IFSCA), GIFT City offers streamlined services across securities, banking, insurance, and pensions.

Gift City isn't just a financial district –

It's India's gateway to the future of global finance

Why Invest in GIFT City

India is a land of opportunities and has emerged as one of the fastest-growing economies in the world. With a developing economy and a sizable population, India has emerged as a desirable location for investors.

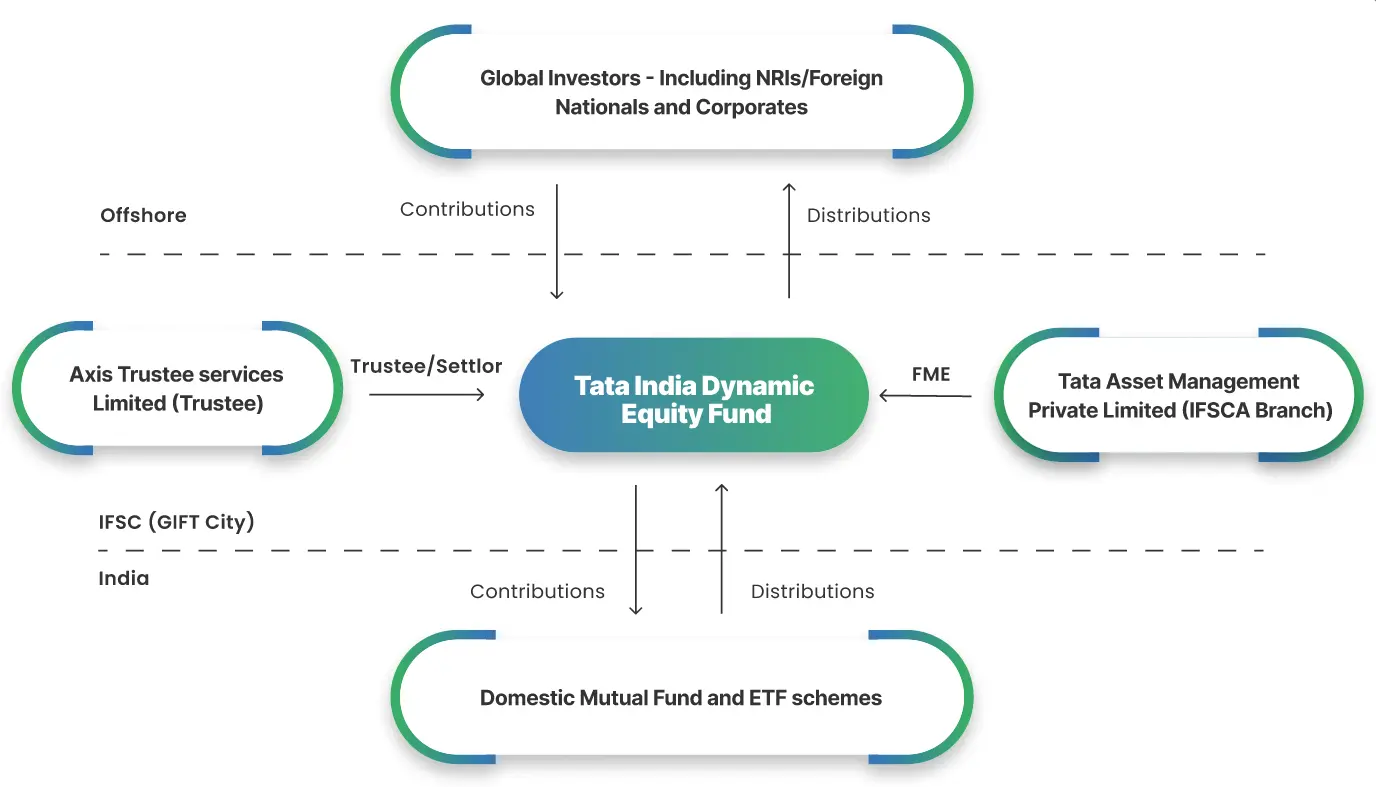

Seamless Cross-Border Transactions

Unlike traditional investments, Foreign Portfolio Investor (FPI) licenses are not required, and investors can directly remit funds from their foreign bank accounts to the Fund's bank account in GIFT City—eliminating the need to open a local bank account or Demat account.

Gateway for Global Investors

Tap into India's growth story, with over 30 million Indian diaspora and foreign investors gaining access to both domestic and international market solutions

Simplified Tax Compliance

Non-resident investors earning income solely from IFSC-based funds are exempt from filing tax returns in India, and a PAN is not required for investing.

Streamlined Investment Process

A unified regulatory setup simplifies the registration of Funds and Fund Managers, fostering a robust ecosystem that prioritizes investor protection and transparency.

Cost-Effective Jurisdiction

A competitive operational and tax regime comparable to key international financial hubs.

Our Presence

With the evolving landscape of global finance and the increasing demand for cross-border investment opportunities, we have established our presence in GIFT City, Gujarat. Leveraging our deep expertise in fund management, we are committed to providing tailored investment solutions to a diverse range of clients. Tata Asset Management IFSC- Branch is registered with the International Financial Services Authority (IFSCA) as a Registered Fund Management Entity (Registered FME) (Retail) bearing registration number: FDM2025FMR0789All approvals, including those from IFSCA, SEBI, and SEZ, are in place, marking a significant milestone in our journey.